Can you claim Section 179 and EV tax credit?

If you are a business owner who purchased a new or used vehicle for your business in 2022, you may be wondering if you can claim both the Section 179 deduction and the electric vehicle (EV) tax credit. The answer is: it depends.

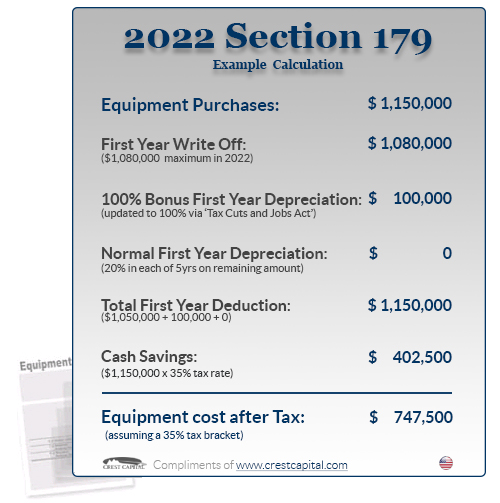

The Section 179 deduction allows eligible businesses to deduct the full cost of qualifying equipment and machinery, including vehicles, up to a certain limit. For 2022, the limit is $1.05 million, with a phase-out threshold of $2.62 million. However, not all vehicles are eligible for the full deduction. Generally, the vehicles must be used more than 50% for business purposes and meet one of the following requirements:

- Have a gross vehicle weight rating (GVWR) of more than 6,000 pounds

- Be a passenger vehicle with a GVWR of 6,000 pounds or less that is either a taxi, a cargo van, or a vehicle with a cargo area of at least six feet in length that is not easily accessible from the passenger area

- Be an ambulance, hearse, or modified non-personal use vehicle

The EV tax credit is a credit for the purchase of qualified plug-in electric drive motor vehicles that are placed in service before 2023. The credit ranges from $2,500 to $7,500, depending on the battery capacity and the gross vehicle weight rating of the vehicle. The credit begins to phase out for each manufacturer once they sell 200,000 eligible vehicles in the United States. For example, Tesla and General Motors have already reached this limit and their vehicles are no longer eligible for the credit.

If you purchased a vehicle that qualifies for both the Section 179 deduction and the EV tax credit, you can claim both benefits on your tax return. However, you must reduce your basis in the vehicle by the amount of the EV tax credit before applying the Section 179 deduction. For example, if you bought a new electric van with a GVWR of more than 6,000 pounds and a battery capacity of 10 kWh for $50,000 in 2022, you can claim an EV tax credit of $7,500 and a Section 179 deduction of $42,500 ($50,000 - $7,500).

However, if you purchased a vehicle that does not qualify for the Section 179 deduction but qualifies for the EV tax credit, you can only claim the EV tax credit on your tax return. For example, if you bought a new electric sedan with a GVWR of less than 6,000 pounds and a battery capacity of 16 kWh for $40,000 in 2022, you can claim an EV tax credit of $7,500 but no Section 179 deduction.

Therefore, before you buy a vehicle for your business in 2022, you should check if it meets the criteria for both the Section 179 deduction and the EV tax credit. You should also consult your tax advisor to determine the best way to maximize your tax savings.